As self-service checkout becomes more widespread, customers expect multiple ways to pay. While this makes for a good customer experience, it presents a challenge for organizations that accept payments across multiple departments and lines of business. From problems reconciling transactions to difficulty detecting fraud, many of the payment processing solutions on the market today fail to meet the complex payment needs of modern enterprises.

Thankfully, EPI-USE ERP Payment Recon offers a better way through cloud-native solutions to some of the most pressing problems of legacy payment processing technology. In this post, we’ll explore how ERP Payment Recon is different from existing solutions and how it can you alleviate pain points from transaction reconciliation in SAP, multi-merchant transaction tracking, fraud detection, and more.

Multi-vendor approaches are complex

At the enterprise level, multiple business units with varying requirements for payment processing often end up signing contracts with different payment service providers to meet their unique needs. This approach creates a number of enterprise challenges that ERP Payment Recon addresses including:

- Inefficient and manual financial processes for reconciling transactions in SAP

- Difficulty maintaining compliance due to inconsistent and disparate data sources

- Increased difficulty detecting fraud and fraudulent activity across multiple payment vendors

- No standard way for tracking down specific transactions and managing exceptions

Fraud, especially, is a problem in this kind of multi-vendor approach. High payment volume across accounts receivable and accounts payable makes it hard to catch fraud when it happens, potentially causing serious financial and reputational damage. With such high stakes, it’s easy to see why early real-time fraud detection is so crucial.

Introducing EPI-USE ERP Payment Recon

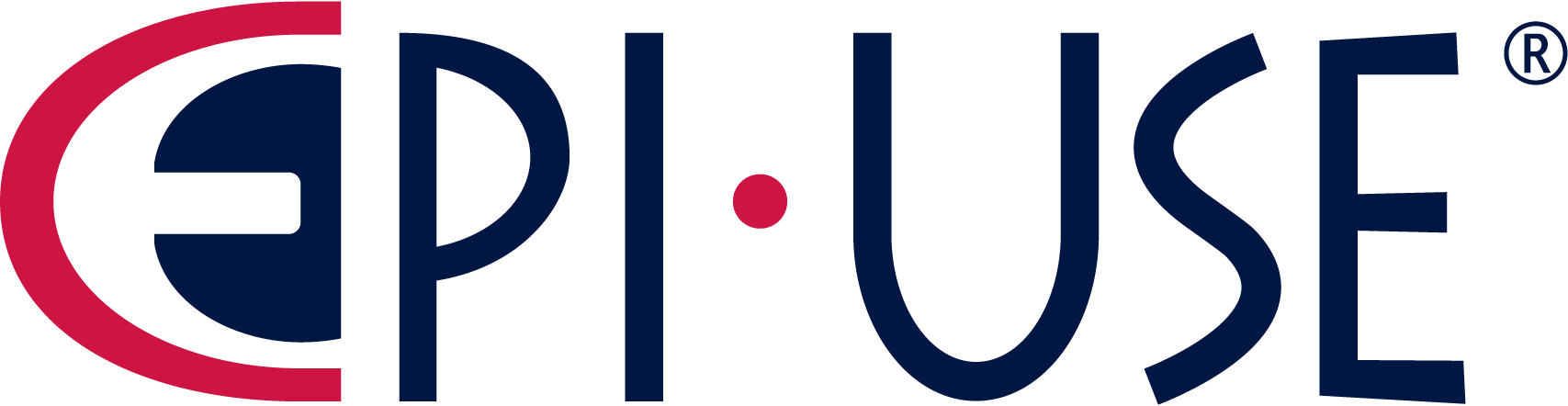

Figure 1 ERP Payment Recon Solution

At EPI-USE, we knew there had to be a better way for organizations to accept digital payments. Our solution is ERP Payment Recon, a new cloud-native payment processing tool for AWS customers to gain access to real-time transaction reconciliation, automated and integrated transaction processing, and the ever-growing list of AWS cloud services from within SAP.

With ERP Payment Recon, you can:

- Accept multiple payment methods, including card, ACH, and digital wallets like Apple Pay, Visa Checkout, and Masterpass

- Reference transactions in a way tailored for reconciliation with SAP Finance, both in the cloud and on premise.

- Set up an automated and integrated bridge between transaction processing and core accounting

- Process refunds and voided payments

ERP Payment Recon uses the AWS SDK for SAP ABAP to connect external digital payment acceptance systems and processes to a standard accounts receivable workflow. It also lets you manage the flow of transactions from any payment service provider or payment instrument into SAP Finance.

This gives you considerably more automated control over digital payment channels and gives finance departments the ability to facilitate business requirements without having to take on additional day-end and month-end reconciliation tasks.

Using the AWS ABAP SDK for SAP means you get access to the AWS library of over 200 cloud services from within SAP, including Amazon EC2, Amazon S3, Site-to-Site VPN, Amazon Web Application Firewall (WAF), and, notably, AWS Fraud Detector.

AWS Fraud Detector lets you identify potentially fraudulent activities and catch online fraud faster. By embedding fraud detection into the accounts payable workflow, ERP Payment Recon offers a last line of defense before posting to the bank, interrogating payment files and flagging suspicious payments. From there, ERP Payment Recon sends flagged payments for re-evaluation within the accounts payable workflow to better protect your organization from fraud.

Key features

Now that we’ve introduced ERP Payment Recon, let’s take a closer look at some of the solution’s unique features.

Solution architecture with SAP

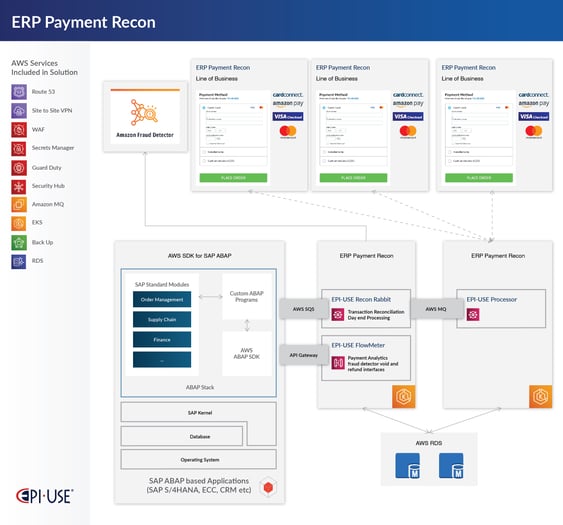

ERP Payment Recon features a modular and elastic architecture, letting you deploy reconciliation, fraud detection, and transaction oversight according to your specific needs and financial workflows.

Figure 2 Solution Architecture with SAP

Core modules are deployed to AWS Elastic Kubernetes Service and provide extensions to all payment endpoints, enriching transactions with metadata and automatically posting those transactions to the appropriate accounts receivable general ledgers. ERP Payment Recon also allows for bi-directional integration with SAP, allowing line of business applications to associate transactions with the correct contract accounts and business partner numbers.

Figure 3 AWS ABAP SDK

The AWS ABAP SDK provides simple access to many AWS services for SAP customers, whether in the AWS cloud or on-premises. ERP Payment Recon also leverages the SQS messaging framework, allowing for transactional message flow between payment service providers, card processors, and ACH networks directly into SAP.

Messaging allows you to track a transaction from authorization all the way through to funding events with your bank — all from within your SAP environment. This means you don’t have to manually interact with reporting from third-party payment providers or manually post-day-end transactions.

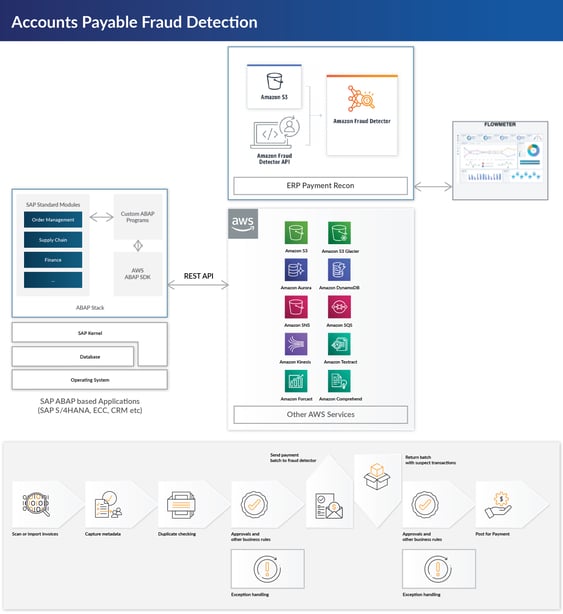

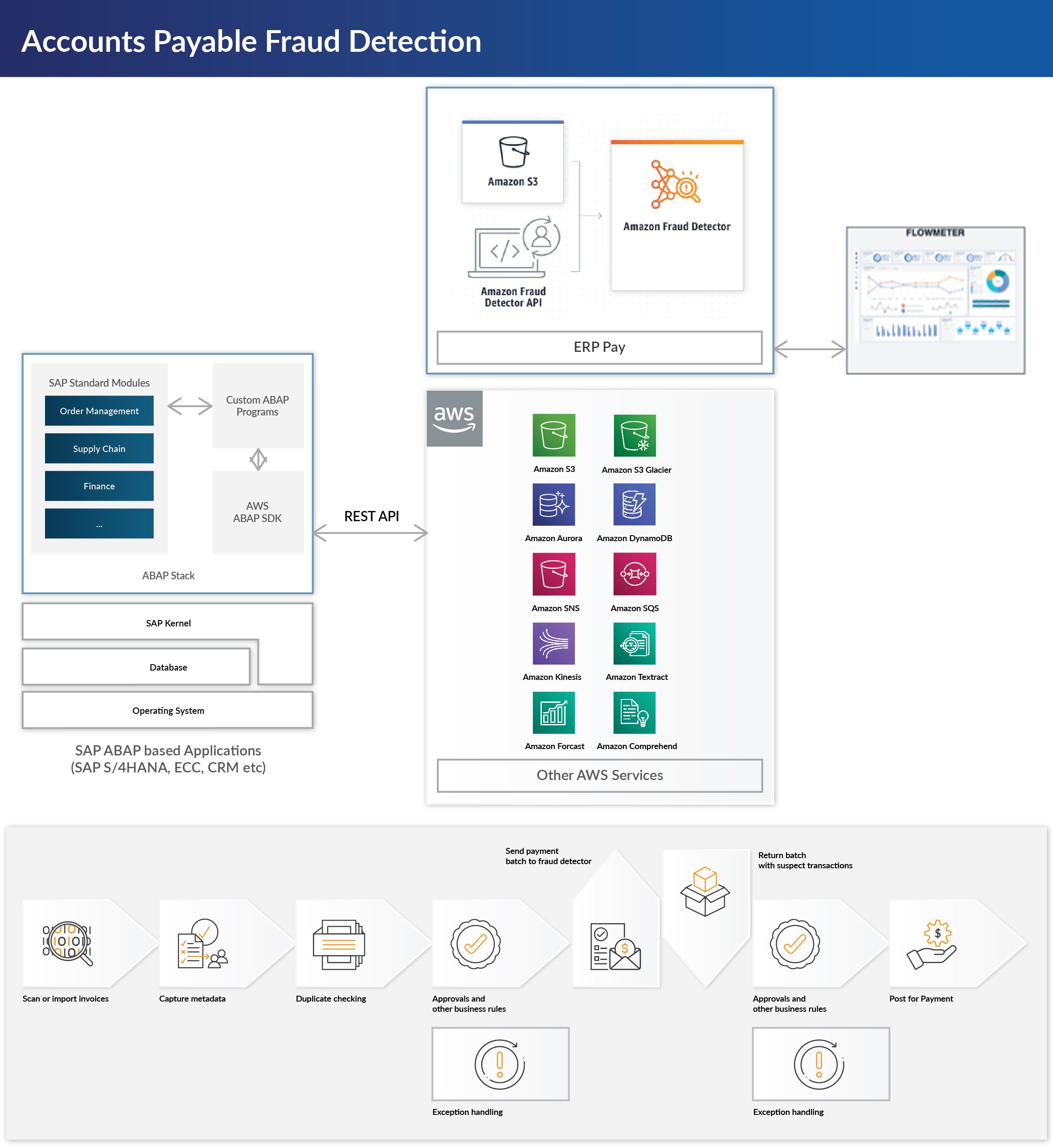

ERP Payment Recon and AWS Fraud Detector for Accounts Payable

Figure 4: ERP Payment Recon and AWS Fraud Detector

AWS Fraud Detector supports complex fraud detection models, with easy SAP integration through the AWS ABAP SDK for SAP. You can insert fraud detection into your accounts payable process, providing continuous defense against outbound fraud payments.

Here are some of the benefits of using AWS Fraud Detector with ERP Payment Recon:

- Continuous learning and improvement of advanced AWS machine learning models

- Real-time fraud detection and potential identification of fraudulent transactions

- Scalable to include both inbound and outbound payment transactions in the future

- Customizable fraud and AWS rules

- Fraud insights and reporting

Example use cases

Higher education

Whether through SaaS applications or SAP, student-facing applications for accepting payment can vary across departments and digital touchpoints. ERP Payment Recon integrates with these SaaS and ERP tools for combined financial reporting across all payment endpoints and real-time reconciliation with SAP.

Healthcare providers

Hospitals and clinics accept digital payments from patients for services like consultation fees, pharmaceuticals and medical supplies, parking, and admission deposits. ERP Payment Recon helps healthcare professionals provide timely and critical care while reconciling payment transactions to SAP in real-time.

Local government

Sanitation services, water, sewage, property tax collection—local governments accept payments from residents in a number of ways and for a variety of services. ERP Payment Recon from EPI-USE brings these transactions together for combined financial reporting and real-time reconciliation with SAP.

Ready to simplify payment processing?

EPI-USE ERP Payment Recon provides enterprises with full, transaction-level visibility, traceability, and compliance across the digital payment landscape with the ability to manage transaction flow from any payment service provider or payment instrument into SAP finance.

If you’re looking for a way to extend digital payment channels with considerably more automated control, contact our Payment Services team to learn more about how ERP Payment Recon can help your organization simplify online payment processing.