Digital payments for the Enterprise

Integrated, Automated and Reconciled.

Deliver digital self-service payments while leveraging your ERP investment.

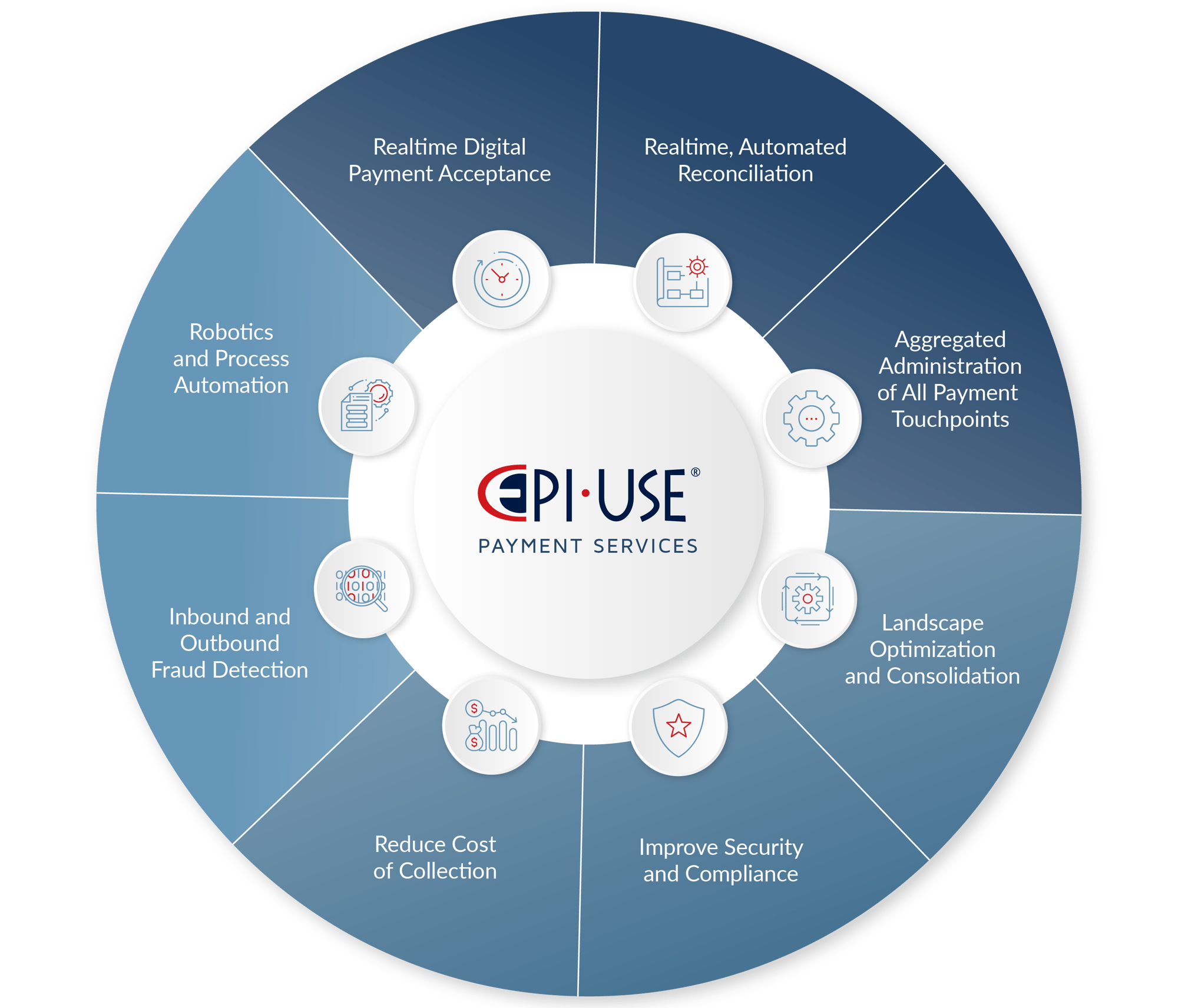

EPI-USE ERP Payment Recon offers our clients considerable benefits in digitizing their payment collection and reconciliation.

ERP Payment Recon provides software and services focused on the revenue collection life cycle. Our payment landscape analysis provides clients with a unique and detailed view of their payment landscape and potential areas of optimization.

ERP Payment Recon has a unique approach to simplify the complicated landscape of payment service providers and payment instruments. This gives our clients a broader reach while reducing costs and streamlining accounts reconciliation. Our approach is payment service provider and technology agnostic to provide the best solution for their specific scenario.

Our platform enables an automated and integrated bridge between transaction processing and core accounting, including control of ancillary functionality like refunds, voids, chargebacks and Automated Clearing House transactions. Clients can leverage economies of scale for payment acceptance whilst maintaining flexible payment options for users.

Review your Payment landscape today

Payments can be complex and intimidating. Let ERP Payment Recon assist you in reviewing your current landscape, and help you to optimize and highlight opportunities and efficiencies.

ERP Payment Recon

ERP Payment Recon

ERP Payment Recon from EPI-USE provides the capability to manage the flow of transactions from any payment service provider or payment instrument, into your ERP finance system of record. In environments that are accepting payments from multiple service providers and or multiple merchant accounts the day-end requirements for each account against specific core accounts becomes an onerous and manual task.

ERP Payment Recon allows clients to extend their digital payment channels with considerably more automated control and allows finance departments to facilitate business requirements without having to take on additional day-end and month end reconciliation tasks. ERP Payment Recon provides a platform for management by exception rather than having to actively participate in the process.

For more information, click here.

Benefits:

|

Digital Payment Acceptance

With over 20 years of experience in fintech and payment technology, ERP Payment Recon assists our clients to extend self service payments to their users.

Selecting the right payment service provider and the best payment instruments whether B2C, B2B, B2G, G2C or any combination thereof. ERP Payment Recon will assist in planning and delivering a solution that leverages economies of scale, provides automated control to finance and is tailored specifically to your organization.

Benefits:

|

Digital Payment Landscape Analysis

The payment landscape analysis focuses on cost optimization for digital payments across the enterprise. As various business areas implement different payment solutions it frequently results in non optimal pricing that is applied for some or all of the payment touch points. A number of fees influence the cost of a digital payment and this can be optimized with volume discounts, interchange optimization, transaction fees and bank charges.

As part of this analysis the current fees and payment service providers (PSP’s) will be benchmarked against industry norms and competitive products with recommendations for aligning the landscape for an optimal total cost of ownership and digital payments operating model.

A large focus of this analysis is the optimization of volume price discounts and interchange optimization.

Benefits:

|

Payment Fraud Detection

EPI-USE ERP Payment Recon allows integration from ERP Finance to AWS Fraud Detector to identify potentially fraudulent activities and catch online fraud faster.

By embedding fraud detection into the accounts payable workflow, ERP Payment Recon offers a last line of defence prior to posting to the bank. Integration to Accounts Receivable can reduce chargebacks and unnecessary costs to the organization. Interrogating the payment files destined for the bank, Fraud detector will flag suspect payments and ERP Payment Recon will send them for re-evaluation within the accounts payable workflow.

Benefits:

|

SAP Digital Payment Add-On

The SAP digital payments add-on enables you to connect SAP and non-SAP consumer applications with non- SAP payment service providers (PSPs). Its function is to facilitate secure, end-to-end processing of digital payments.

ERP Payment Recon specializes in the implementation of the SAP digital payments add-on product. This is a cloud service that allows companies to process incoming credit card payments and other real-time payment methods in a secure and efficient way. This helps to significantly reduce cash reconciliation efforts for all companies running any variant of SAP order/sale-to-cash processes (B2B, B2C, POS, web shops, and so on) who need to offer their clients flexibility and access to multiple digital payment methods.

Benefits:

|

Elevate your business with ERP Payment Recon

Unlocking the potential of AWS, combined with the power of EPI-USE's ERP expertise, ERP Payment Recon is the intelligent and automated solution to your payment processing challenges.

Benefits

Experienced

Serving millions of users across many disciplines globally, ERP Payment Recon brings a wealth of payment and reconciliation experience to your organization.

Process Automation

Our digital workforce can integrate and automate a myriad of disparate tasks across legacy and siloed systems, reducing manual tasks and increasing visibility and productivity.

Cloud-oriented

ERP Payment Recon systems support full AWS deployment, hybrid and private cloud. Our software is managed and operated for our clients 24/7, 365 days a year.

Development

ERP Payment Recon will expand and enhance our service offering specifically tailored to your requirements. Our platform is highly extensible and we offer specialized extensions for clients who require it.

Consulting and Analysis

ERP Payment Recon offers a complete consulting and advisory service to its clients on issues ranging from program implementation and enhancement, cost benefit and risk analysis to training and strategic alignment.

Governance and Compliance

ERP Payment Recon advisory and consulting services assist our clients in the payment compliance space and help to reduce the PCI compliance burden on clients.

Contact us

If you would like more information about any of our services or you would like to collaborate with us, please fill in the contact form.

EPI-USE is committed to protecting your privacy. If you would like to receive emails from us, such as invitations, access to webinars and latest SAP insights, please tick the box above.

You may unsubscribe from these communications at any time. We store your data securely and we don’t pass your data to any other companies. Read more in our Privacy Policy and Cookie Policy.

By clicking submit, you consent to allow EPI-USE to store and process the personal information submitted above to provide you the content requested.